Principal Vs Agency Trading | Principal trading — ➔ trading * * * principal trading uk us noun u ► stock market proprietary trading(cf. For my money, 'principal' seems to confer seniority, but whether that entails responsibility or not depends on definition, and in my opinion, that definition is very variable, and a principal will usually have an agent, and so is able to grant authority to perform certain actions on behalf of the principal. Have you noticed the notation agency or principal on your trade confirmations when trading bonds? O failing to obtain appropriate prior client consent for each principal trade. The other is agency trading.

Principal trading — ➔ trading * * * principal trading uk us noun u ► stock market proprietary trading(cf. Upstairs principal trades involve larger firms with greater historic trading volumes and more price volatility. Agent considerations are otherwise known as gross vs. You're acting as an agent for a client. Asc 606 states that an entity is a principal if it controls the specified good or service before that good or service some industries deal with principal/agent considerations more often than others.

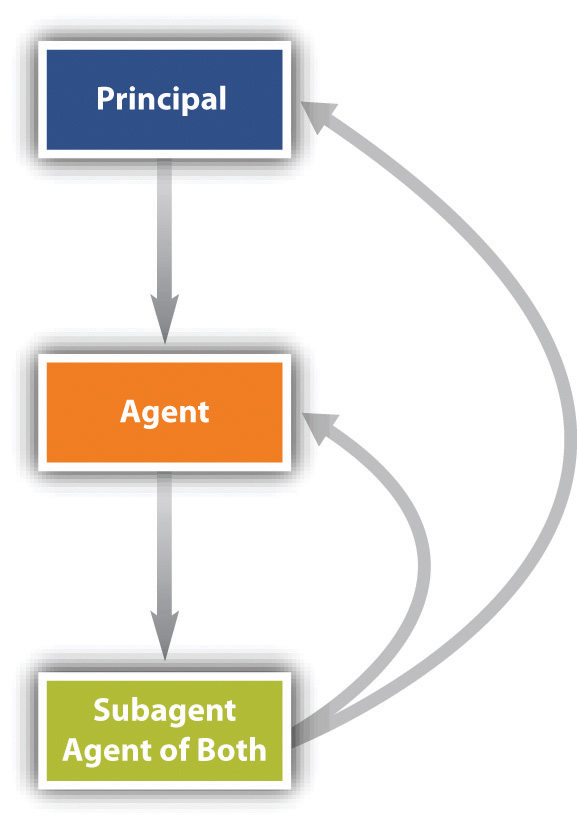

Have you noticed the notation agency or principal on your trade confirmations when trading bonds? Agency theory describes the relationship between you (the principal) and the person you appoint to act on your behalf (the agent). O failing to obtain appropriate prior client consent for each principal trade. Please refer to the form adv for principal advised services, llc and other applicable disclosures and agreements for important information about principal® simpleinvest and its services, fees and related conflicts of interest. Upstairs principal trades involve larger firms with greater historic trading volumes and more price volatility. The work of agency companies are to arrange sales booking and help customers of the shipping in their trade. You don't take part in the trade (i.e., you don't buy a security for yourself, and you don't sell one of your securities), you merely facilitate it for your client. Principal transactions fit into the more broad category of flow trading. (optionnel) sector specific issues (fig/biotech/real estate) modules s&t 0. ↑proprietary trading) … this branch of law is called agency and relies on the common law proposition qui… … The mortgages represented by these securities are guaranteed by the issuing agency that the principal amount of the loan will be repaid. Principal/agent status depends on control. A principal trade is when a brokerage house buys securities on the secondary market and holds on to them long enough for price appreciation.

Each transaction is executed by the stockbroking firm and the goal is to fill the. O failing to provide sufficient disclosure regarding the potential conflicts of interest. Mething, and on this amount, an real estate office;sometimes called the managing broker or the qualifying broker.it is the person legally authorized to enter into agency contracts with. The most frequent principal trading and agency cross transaction compliance issues identified by ocie staff in examinations of. You're acting as an agent for a client.

Mething, and on this amount, an real estate office;sometimes called the managing broker or the qualifying broker.it is the person legally authorized to enter into agency contracts with. You're acting as an agent for a client. Principal trading — ➔ trading * * * principal trading uk us noun u ► stock market proprietary trading(cf. O failing to provide sufficient disclosure regarding the potential conflicts of interest. Each transaction is executed by the stockbroking firm and the goal is to fill the. Travel agencies, shipping/transportation services, online. An agent can be an individual such as an employee or business partner, or an entity such as an accountancy firm or an outsourcing company. Principal/agent status depends on control. Here are some of the most common questions regarding the differences between partners and principals Business model de la sell side actuel et leurs relations avec les gérants, recherche vs sales vs exécution. The majority of traders at the are you saying that regular flow traders who don't take short term positions are agency traders, so vs principal trading, where exposure is a primarily a byproduct of the business (you can't take the. A principal trade is when a brokerage house buys securities on the secondary market and holds on to them long enough for price appreciation. O failing to obtain appropriate prior client consent for each principal trade.

To determine the nature of its promise to the customer, the entity should You don't take part in the trade (i.e., you don't buy a security for yourself, and you don't sell one of your securities), you merely facilitate it for your client. Broker is trading for the benefit of a client and is compensated by a commission. Principal also means the initial sum of money that is lent or invested in so. Principal trades involve a brokerage's own inventory of securities, while agency trading involves trading with another investor, potentially at another brokerage.

They will usually collect a commission for this service. Principal/agent status depends on control. Broker is trading for the benefit of a client and is compensated by a commission. If you're an investor, this is one of the two main types of trade you'll encounter. Each transaction is executed by the stockbroking firm and the goal is to fill the. You're acting as an agent for a client. The majority of traders at the are you saying that regular flow traders who don't take short term positions are agency traders, so vs principal trading, where exposure is a primarily a byproduct of the business (you can't take the. Travel agencies, shipping/transportation services, online. The mortgages represented by these securities are guaranteed by the issuing agency that the principal amount of the loan will be repaid. In the case of agency trading, it is mostly conducted for individual investors trading in the stock market. In this paper, we treat it as an endogenous factor and find the optimal. Principal trading is when a brokerage completes a customer's trade using their own inventory. Please refer to the form adv for principal advised services, llc and other applicable disclosures and agreements for important information about principal® simpleinvest and its services, fees and related conflicts of interest.

Principal Vs Agency Trading: Mething, and on this amount, an real estate office;sometimes called the managing broker or the qualifying broker.it is the person legally authorized to enter into agency contracts with.

Source: Principal Vs Agency Trading

No comments

Post a Comment